Top 10 Denim Manufacturing Countries

International trade is increasing with every passing day and resulting in all-time higher imports and exports worldwide. Countries for the purpose of export are producing goods far above then what they can consume within. Top exporting countries of the world play a critical role in the world trade. This map of top jean denim exporting countries highlights the world top countries leading with regards to export.

These countries export the goods and services produced within their countries to most of the countries in the world. These goods and services are then purchased by consumers belonging to different parts of the world. Some of the major exports exported by these countries include textiles and clothing etc. Many retailers/clothing brands have said that without question, denim has passed “the top of the cycle” right now.

Due to anomic demand, and an increasing switch to blends, global denim prices are relatively weak. In terms of trends, a continuing decline in denim capacity over the next few years as inefficient mills in Europe, North America and Asia are dismantled, while at the same time new capacity comes online in China, India, Turkey and Brazil. The growth in these countries and a smaller number of other producers like jean clothing manufacturers in Vietnam, will in time grow to offset declines in less efficient capacity elsewhere.

The cyclical nature of the global denim business seems to indicate a cycle of approximately five years in length, with capacity being added and deleted as fashion and other factors increase and decrease demand for basic denim.

With increasing disposable income and inclination towards western fashion trends, emerging economies are shifting their purchasing patterns towards denim jeans as a part of their casual wear. Higher quality, durability, comfort level, low maintenance, and easy availability are the main reasons for growing demand for denim products amongst the youth.

Despite rising acceptance of denim products across all age groups, demand for men is forecasted to surpass that for women. Evolution of e-commerce has increased accessibility thereby improving distribution channel and facilitating consumption.

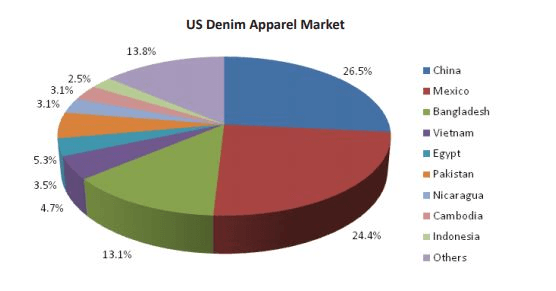

Bangladesh, Vietnam and China are the two South East Asian Countries which have been leading the US denim exports charts for the last few years alongwith Mexico. China was struggling few years back due to surging labor prices however now the country is recovering.

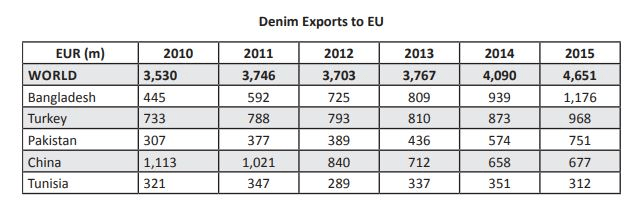

Largest supplier of denim garments to EU is Bangladesh followed by China. Demand growth for the next six years is expected to largely emanate from Asia (12%), Latin America (15%), North America (10%), Europe (4%), Mexico, Vietnam and China. Top denim fabric importing countries include Bangladesh and Mexico.

Bangladesh: Bangladesh is recognized as one of the most significant centers for denim apparel production around the globe. It ranks as the second largest denim garments exporter after China. Bangladesh currently imports almost half of its fabric requirements from India, Pakistan and China. However, growing consumption of denim and expected increase in global demand has created opportunity for Bangladesh to enhance the productivity and efficiency of its denim mills thereby reducing its reliance on imported denim fabric. Overall denim capacity is witnessing significant increase and will impact players who are currently exporting to Bangladesh.

On garments front, industry players are increasing capacity in order to maintain current market share in global trade and to boost total denim exports to $7b by 2021. The country enjoys advantage in terms of one of the lowest cost of doing business with expenses being lower by around one-third as compared to Pakistan. The future of the denim industry appears to be bright for Bangladesh’s economy on the back of competitive pricing, low labor cost and focus on product innovation.

Bangladesh is the largest exporter of denim products to the EU, with 27% of the market share— third largest to US market with a 14% market share .

According to Office of Textiles and Apparel (Otexa) of the US, from January to September, 2018, Bangladesh earned $419.21 million from denim exports, up by 14.20%, which was $367.10 million in the same period last year.

According to Eurostat, statistics directorate of the European Commission, the latest data, for January to August, 2018, Bangladesh earned €917.14 million exporting denim goods to European Union Countries—which is 4.23% higher, compared to €879.84 million in the same period a year ago.

India: Despite declining denim apparel exports, the denim sector in India is growing at a consistent CAGR of 13% to 15% per year led by escalating local demand. India’s share in global denim jeans trade account for 2.5% with 10% share in global denim manufacturing capacities. The Indian denim industry enjoys the advantage of suitable cotton, induction of state-of-the-art production plants and large local market where increasing consumption of denim products is being witnessed. Indian denim industry is primarily aiming to increase its share in exports, which currently stands at around one-third of total production. The total denim fabric capacity of the country stands at 1.2b meters/annum reporting utilization levels of 75%, of which only 28% is exported. Although the urban and rural Indian markets contribute to the overall share of denim, the average number of denim items owned by Indian consumers is much lower (0.3) in comparison to other markets like the US (9), the UK (8) and Brazil (7). This demonstrates the huge potential that still remains untapped in the domestic market.

China: Statistics reveal that Chinese denim exports are following a declining trend owing to increase in labor cost in XintangHub of Textile Manufacturers in China- thereby making their denim products expensive compared to other regional players. However, demand growth is expected to remain healthy due to sizeable millennial generation who reside in middle-class cities. Additionally, the same is evident from denim jeans sales growth of 5% registered during 2016 valued at $11.8b. Chinese per capita ownership of denim garments stand at 7 items slightly lower than U.S (9) and Mexico (12).

If you are looking for FOB/ OEM/ ODM jean clothing factory in Vietnam, we are pleased to discuss with you will full services: FOB/ OEM/ ODM jeans manufacturing service. For more details, please contact us at:

THUAN HAI JEANS GARMENT FACTORY LTD

Address:: 17A, No 24, Linh Dong Ward, Thu Duc District, Ho Chi Minh City, Vietnam

Hotline: +84 976 845 374 (Whatsapp, Zalo)

Email: jeanthuanhai@gmail.com

Chat with us on WhatsApp: https://wa.me/+84976845374